Public Tax Lien Records

Understanding a Federal Tax Lien | Internal Revenue Service - IRS tax forms

You owe $25,000 or less (If you owe more than $25,000, you may pay down the balance to $25,000 prior to requesting withdrawal of the Notice of Federal Tax Lien) Your Direct Debit Installment Agreement must full pay the amount you owe within 60 months or before the Collection Statute expires, whichever is earlier

https://www.irs.gov/businesses/small-businesses-self-employed/understanding-a-federal-tax-lien

Free Federal Tax Lien Search - SearchQuarry.com

They typically take 30 to 45 days to remove the tax lien from your public record. It is also best practice to follow up with the major credit reporting agencies to insure they’ve received the release of your tax lien. This can affect your ability to obtain credit, or buy property if the lien is on your credit report.

https://www.searchquarry.com/free-federal-tax-lien-search/

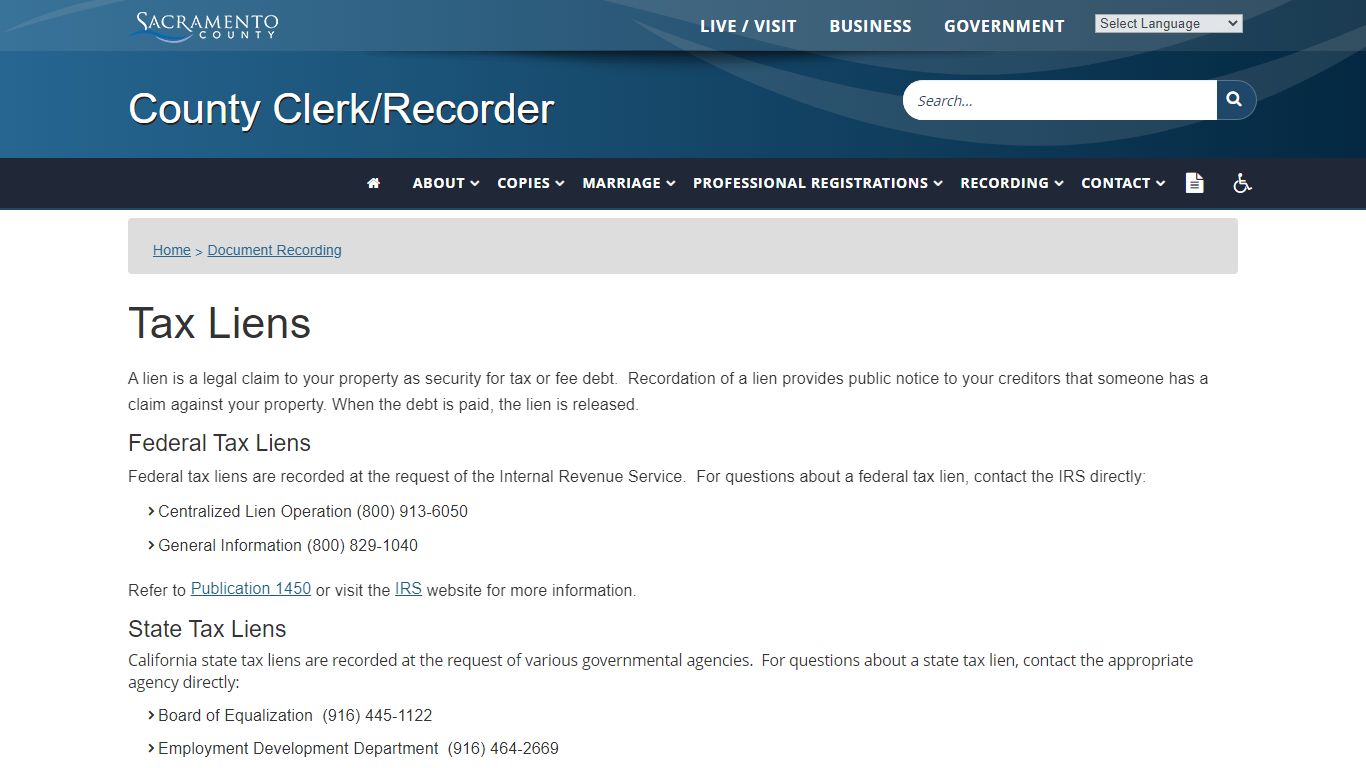

Tax Liens - Sacramento County, California

California state tax liens are recorded at the request of various governmental agencies. For questions about a state tax lien, contact the appropriate agency directly: Board of Equalization (916) 445-1122 Employment Development Department (916) 464-2669 Franchise Tax Board (916) 845-4350 or (800) 852-5711 Locate a lien or release

https://ccr.saccounty.gov/DocumentRecording/Pages/TaxLiens.aspx

PROPERTY TAX-LIENS - Los Angeles County Treasurer and Tax Collector

If you have a lien filed against you by another entity or person, such as the Internal Revenue Service, the Franchise Tax Board, the Employment Development Department, or a contractor, please contact that entity or person directly. You may request a copy of a lien filed by another entity or person by visiting the

https://ttc.lacounty.gov/property-tax-liens/

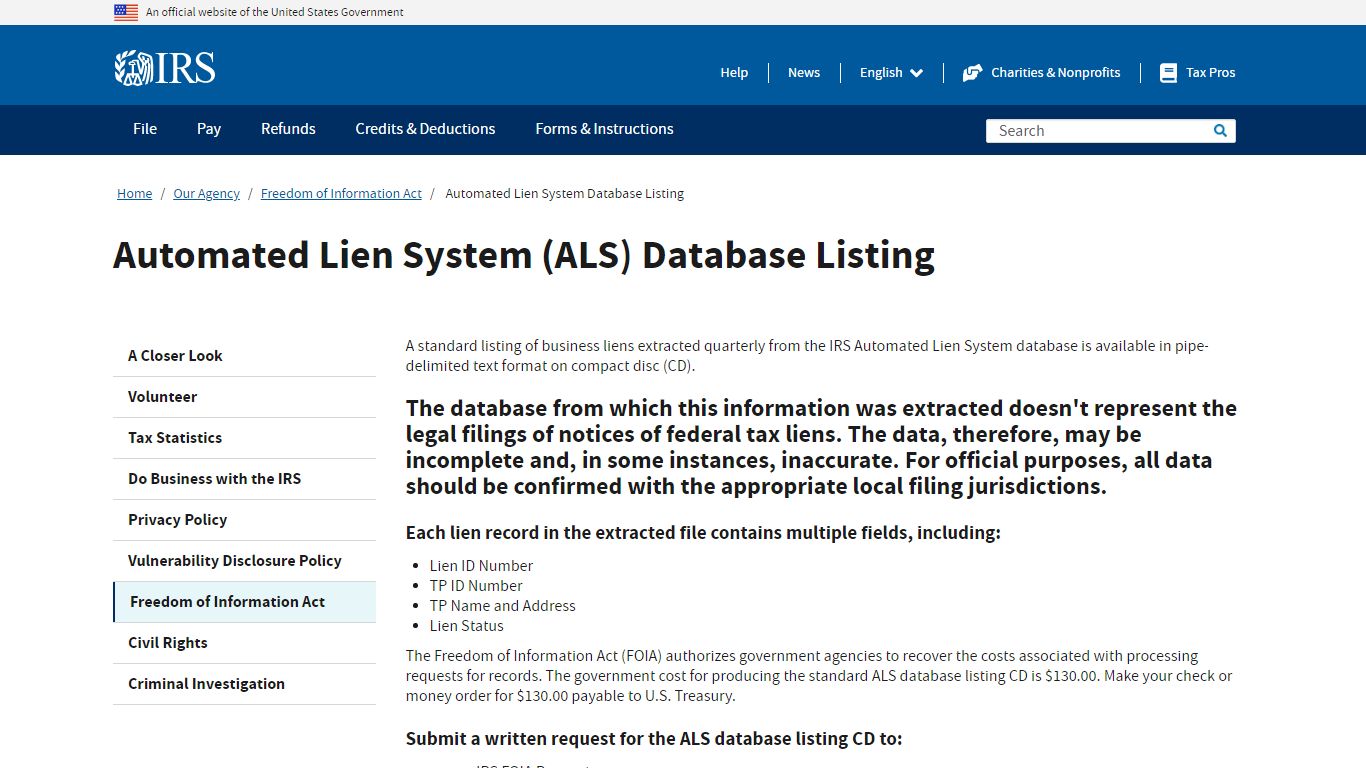

Automated Lien System (ALS) Database Listing - IRS tax forms

Lien Status The Freedom of Information Act (FOIA) authorizes government agencies to recover the costs associated with processing requests for records. The government cost for producing the standard ALS database listing CD is $130.00. Make your check or money order for $130.00 payable to U.S. Treasury.

https://www.irs.gov/privacy-disclosure/automated-lien-system-database-listing

Liens Search | StateRecords.org

In many cases, a lien becomes part of the public record, and anyone who plans to purchase or refinance that property must be informed about liens against it. The type of lien, the date recorded, and the amount owed are all made part of the record in what is known as a "Liens" index. If a lien exists, it will be in this index.

https://staterecords.org/liens

Tax Lien Registry - Tax Lien Registry - Illinois

The State Tax Lien Registry was created in accordance with Public Act 100-22 which created the State Tax Lien Registration Act. The State Tax Lien Registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the Illinois Department of Revenue (IDOR). The liens included in the State Tax Lien ...

https://www2.illinois.gov/rev/programs/TaxLienRegistry/Pages/default.aspx

Liens - Clark County, NV

a Mechanics Lien recorded by the person furnishing labor or materials for construction work, a Government Lien recorded by a government agency for the failure of the owner to pay personal, business or real property taxes, and; a Judgment Lien issued by a court on all real property owned by the judgment debtor. Search Official Records for liens

https://www.clarkcountynv.gov/government/elected_officials/county_recorder/liens.php

Liens And Research - Maricopa County, Arizona

Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for the Tax Lien Sale. The sale takes place in early February of each year online at https://maricopa.arizonataxsale.com. Please read the disclaimer before deciding to bid, and see our lien FAQ Page and Lien History Page .

https://treasurer.maricopa.gov/Pages/LoadPage?page=LiensAndResearch

California Tax Records Search - County Office

Tax Records include property tax assessments, property appraisals, and income tax records. Certain Tax Records are considered public record, which means they are available to the public, while some Tax Records are only available with a Freedom of Information Act (FOIA) request. Find Tax Records, including: California property tax records

https://www.countyoffice.org/ca-tax-records/